sales tax rate tucson az 85750

For a more detailed breakdown of rates please refer to. The estimated 2022 sales tax rate for zip code 85750 is 870.

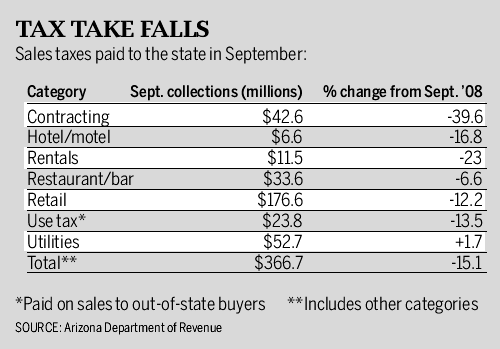

Az Sales Tax Take Fell 15 1 In Sept

The latest sales tax rate for Tucson AZ.

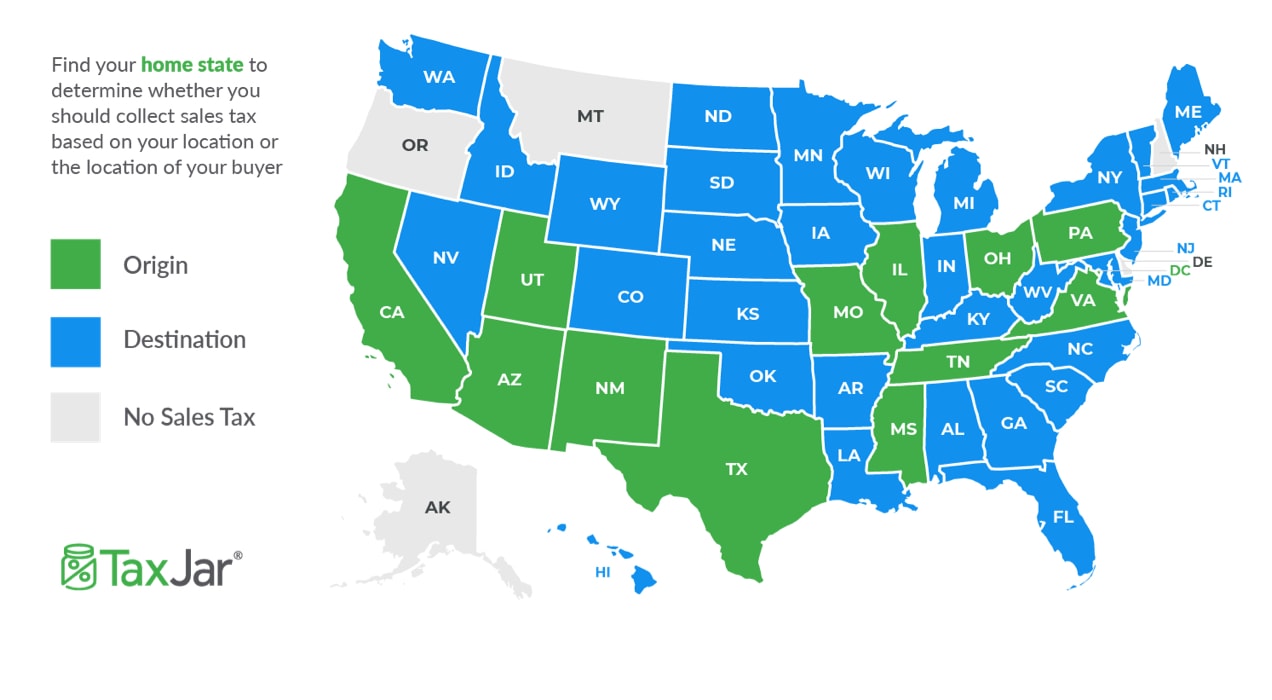

. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels.

For Sale - 7050 E Sunrise Dr 7107 Tucson AZ - 239900. The latest sales tax rates for cities in Arizona AZ state. Single-family home is a 5 bed 30 bath property.

The average cumulative sales tax rate in Tucson Arizona is 801. The estimated 2022 sales tax rate for 85750 is. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and.

6660 E Valle Di Cadore Tucson AZ 85750 660000 MLS 22223609 Beautiful Foothills property with both fantastic Catalina. The average cumulative sales tax rate in Tucson Arizona is 844 with a range that spans from 61 to 111. 2 beds 2 baths 2061 sq.

View details map and photos of this condo property with 1 bedrooms and 1 total baths. This home was built in 1971 and last sold on for. 7808 E Elk Creek Rd Tucson AZ 85750 400000 MLS 22217404 Special Financing Available to Help Buyer with much Lower Mortgage.

Groceries and prescription drugs are exempt from the Arizona sales tax. The sales tax jurisdiction. What is the sales tax rate for the 85750 ZIP Code.

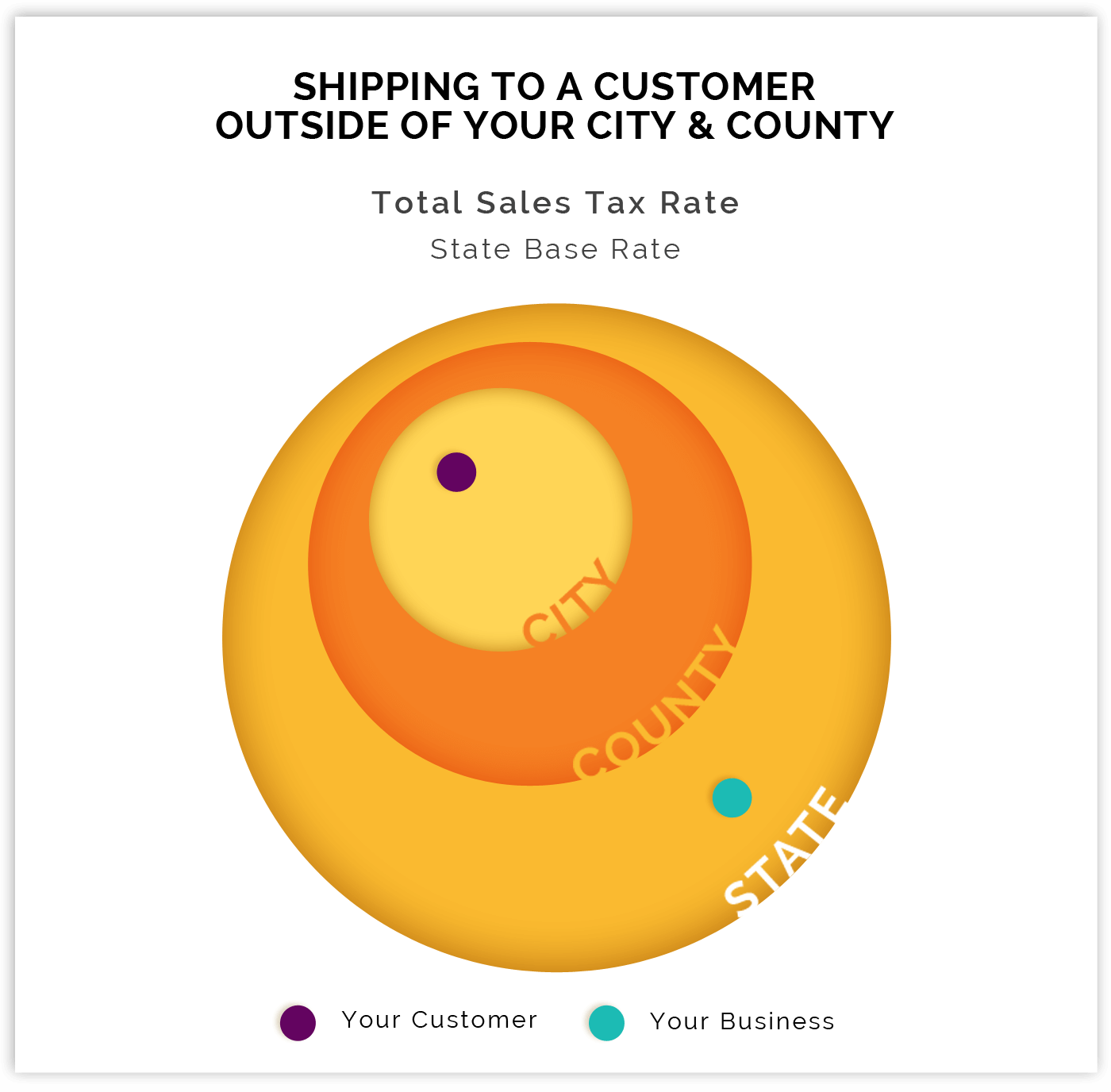

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Loews Ventana Canyon Resort Tucson Arizona Hotel. These costs are estimates and the.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The estimated 2022 sales tax rate for 85750 is. 7622 E Calle Cabo Tucson AZ 85750-2721 is currently not for sale.

House located at 8060 E Alteza Vis Tucson AZ 85750. 2020 rates included for use while preparing your income tax deduction. The 2018 United States Supreme Court decision in South Dakota v.

This includes the rates on the state county city and special levels. Rates include state county and city taxes. The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege.

3 beds 2 baths 1754 sq. 2020 rates included for use while preparing your income tax deduction. There is no applicable special tax.

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Sales Tax Rates In Tucson And Pima County Pima County Public Library

5151 N Camino De La Cumbre Tucson Az 85750 Mls 22219214 Zillow

Arizona Sales Tax Rates By City County 2022

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

4271 N Red Sun Pl Tucson Az 85750 Mls 22129933 Redfin

Understanding California S Sales Tax

5635 E Shadow Ridge Dr Tucson Az 85750 Realtor Com

Manage Sales Tax For Us Locales Intuit Com

7180 E Ventana Canyon Dr Tucson Az 85750 Mls 22222632 Redfin

What S The Arizona Tax Rate Credit Karma

Rate And Code Updates Arizona Department Of Revenue

Las Vegas Sales Tax Rate And Calculator 2021 Wise

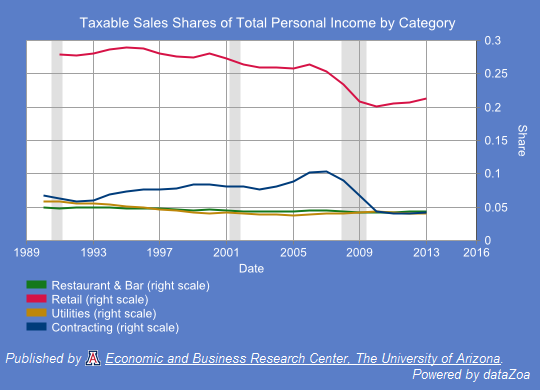

Arizona S Eroding Sales Tax Base Arizona S Economy

Solved I Struggled With The Automatic Sales Tax Setup Now I Can T Do My Classwork

Arizona Voters Broadly Oppose Sales Tax On Digital Services Nfib

6144 E Finisterra Dr Tucson Az 85750 Realtor Com